How to ensure payroll compliance

Why is payroll compliance important? If you don’t play by the rules, you can face fines, audits, and other consequences.

Home > Accounting & Payroll > Taxes

Why is payroll compliance important? If you don’t play by the rules, you can face fines, audits, and other consequences.

Learn more about important tax considerations for businesses and how to do payroll for remote employees in your organization.

With the popularity of cryptocurrency among investors, technologists, and entrepreneurs alike, understanding the tax implications is critical.

Employees are no strangers when it comes to using their personal vehicles for work purposes. Some employees travel to and from multiple job sites, some use their car to complete work tasks, …

Didn’t do your taxes yet? You may have some more time, according to the IRS.

If you’re a procrastinator, much like the 50-million people who didn’t file their taxes in 2019 until April 15th, I have good news for you! The U.S. Department of Treasury and Internal …

Many California employees and employers faced challenges as the coronavirus impacted their workplaces. During this difficult time, business owners had to make tough decisions in order to stay afloat. Ultimately, this led …

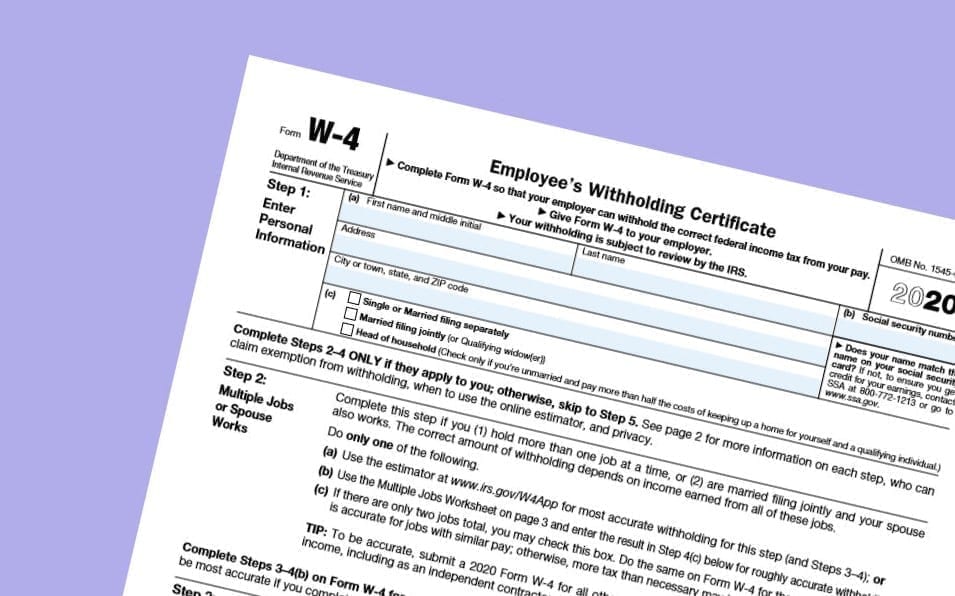

There have been a lot of changes in 2020 in regards to the US overtime policy salary history bans in Ohio, New York, and New Jersey, and the federal mileage rate. In …

* As of March 21st, 2020, The Treasury Department and Internal Revenue Service extended the federal income tax filing due date from April 15, 2020, to July, 15, 2020. Taxes are difficult …

If you run a small business, you’re going to want to file your tax deductions accurately. Properly filing tax deductions will give you a larger tax return. Unfortunately some businesses are not …

We Help Thousands of Employers Manage Time, Time Off, and Expenses