For accountants and bookkeepers responsible for expense reports and payroll, managing business expenses can be daunting. From reconciling expense reports to tracking mileage, the challenges of manual expense tracking can hinder accounting accuracy and efficiency.

However, with powerful expense tracking software, accountants can streamline operations, improve accuracy, and save valuable time.

This guide explores how expense tracking solutions can revolutionize accountants’ handling of business expenses, from receipt collection to generating reports for tax purposes. We’ll delve into the features of the best expense tracking software, discuss integration with popular accounting software like QuickBooks Online, and provide insights on choosing the right expense tracking solution for your needs.

Key Takeaways

- Automated expense tracking software can reduce the time spent on managing expenses by up to 58%, allowing accountants to focus on more strategic financial tasks and improve overall productivity.

- Integrating expense tracking and accounting software can cut data entry errors by as much as 90%, ensuring more accurate financial statements and reducing the risk of compliance issues during tax season.

- Advanced mileage tracking features in expense management tools can help businesses recover an average of 30% more in mileage reimbursements, leading to significant cost savings and more precise expense reporting.

- Implementing an expense tracking solution with receipt scanning capabilities can speed up expense report processing by 75%, dramatically reducing turnaround times for employee reimbursements and improving satisfaction.

- Cloud-based expense tracking platforms enable real-time visibility into business expenses, allowing for more effective cash flow planning and identifying up to 20% of unnecessary expenditures that can be eliminated.

Index Table

- The Challenges of Manual Expense Tracking

- Benefits of Automated Expense Tracking for Accountants

- Key Features of Effective Expense Tracking Software

- Implementing Expense Tracking: Best Practices

- Integrating Expense Tracking with Accounting Software

- Overcoming Common Obstacles in Expense Management

- Future Trends in Expense Tracking Technology

The Challenges of Manual Expense Tracking

Manual expense tracking poses numerous challenges for accountants and small business owners alike. The time-consuming nature of manual data entry reduces productivity and increases the likelihood of errors in financial records.

Time-Intensive Processes

Error-Prone and Inconsistent

Policy Enforcement Challenges

Difficulty in Separating Personal and Business Transactions

Benefits of Automated Expense Tracking for Accountants

Time Savings and Increased Productivity

Improved Accuracy and Reduced Errors

Enhanced Visibility and Real-Time Reporting

Better Policy Compliance and Fraud Prevention

Faster Reimbursements and Closing Processes

Effortless Time Management

Get Started with a Free Trial!

Key Features of Effective Expense Tracking Software

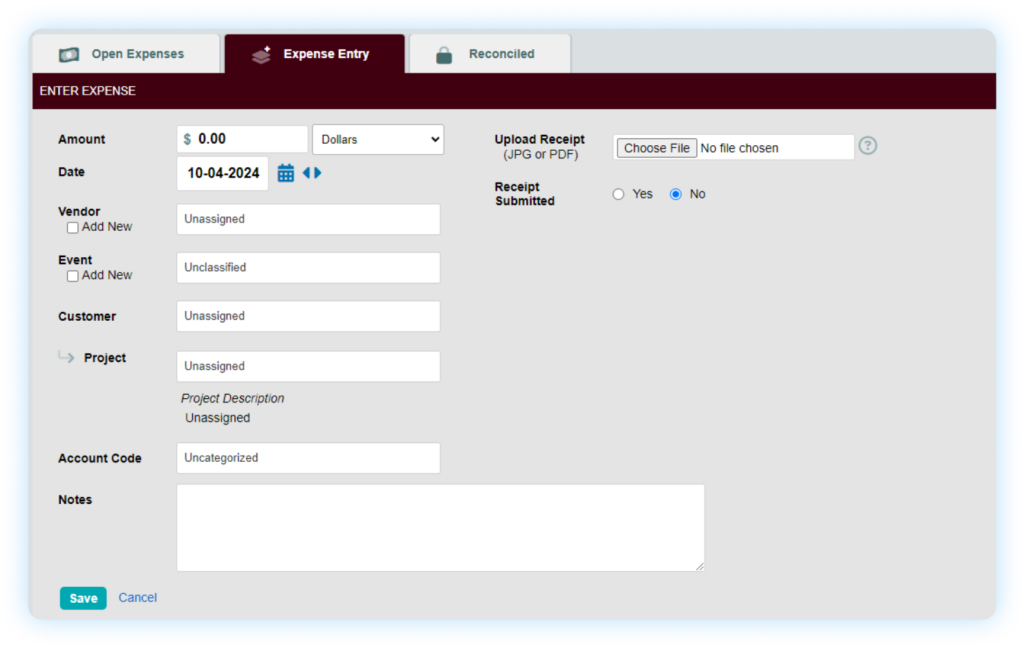

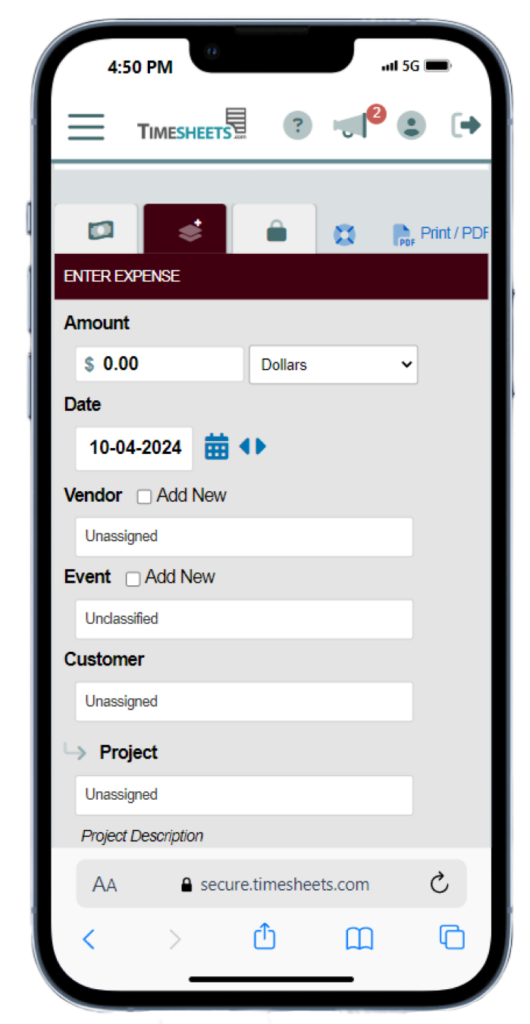

Mobile Receipt Capture and OCR Technology

- Mobile apps for easy receipt uploads

- Optical Character Recognition (OCR) to extract receipt data

- Ability to match receipts with credit card transactions

Automated Categorization and Coding

- AI-powered categorization of expenses

- Custom rules for recurring expenses

- Integration with a chart of accounts for accurate coding

Policy Enforcement and Approval Workflows

- Configurable expense policies

- Automated approval routing

- Real-time policy violation alerts

Integration with Accounting and ERP Systems

- Seamless connection with popular accounting software like QuickBooks Online

- Sync with existing accounting systems for streamlined data flow

- Support for multiple clients and unlimited billable clients

Comprehensive Reporting and Analytics

- Customizable expense reports

- Detailed analytics on spending patterns

- Ability to generate reports for tax purposes and audits

Mileage Tracking and Reimbursement

- Automatic mileage tracking for accurate reimbursement

- GPS-enabled tracking for precise mileage logs

- IRS-compliant mileage reports for tax deductions

By leveraging these features, accountants can significantly improve their mileage & expense management processes, ensuring accurate financial statements and smoother operations for small businesses and larger organizations alike. For more detailed information, see our guide on expense tracking for independent contractors to help streamline operations for freelance professionals.

Implementing Expense Tracking: Best Practices

Choose the Right Software

- Integration with your existing accounting software (e.g., QuickBooks Online)

- Mobile apps for easy expense submission

- Advanced features like automatic mileage tracking

- Support for multiple clients and unlimited users

Train Staff and Executives

- Organize workshops for employees and executives

- Create user guides for different roles

- Offer ongoing support during the transition period

Establish Clear Policies

- Define allowable business expenses

- Set spending limits for different expense categories

- Outline the process for submitting and approving expenses

Regular Review and Optimization

- Analyze expense data regularly

- Gather feedback from users

- Update policies and procedures as needed

Unlock Productivity

Begin Your Free Trial Now!

Implementing Expense Tracking: Best Practices

Choose the Right Business Expense Tracker

- Integration with your bank accounts for automatic transaction import

- Mobile expense tracker apps for easy expense submission on the go

- Advanced features like receipt scanning and categorization

- Support for multiple users and clients

Train Staff and Executives

- Organize workshops to demonstrate how to track expenses efficiently

- Create user guides for different roles within the expense tracking system

- Offer ongoing support during the transition period to the new business expense tracker

Establish Clear Policies

- Define allowable business expenses to be tracked

- Set spending limits for different expense categories

- Outline the process for submitting and approving expenses through the expense tracker app

Regular Review and Optimization

- Analyze expense data regularly from your business expense tracker

- Gather feedback from users on the expense tracker apps

- Update policies and procedures as needed to streamline how you track expenses

Integrating Expense Tracking with Accounting Software

Seamless Data Flow

- Automatic import of transactions from connected bank accounts

- Sync expense data with accounting systems for a unified financial view

Automated Journal Entries

- Auto-generate journal entries from expense data tracked in your app

- Reduce manual data entry and associated errors when reconciling bank accounts

Improved Accuracy in Financial Statements

- Real-time expense data updates from your expense tracker app

- Reduced discrepancies between systems and bank accounts

Time Savings in Closings

- Automated expense categorization from your business expense tracker

- Faster reconciliation of accounts with data from expense tracker apps

Boost Efficiency

Dive into a Free Trial Today!

Overcoming Common Obstacles in Expense Management

Employee Resistance

- Highlight the benefits of using expense tracker apps (e.g., faster reimbursements)

- Provide user-friendly mobile expense tracker apps for easy expense submission

Data Security and Privacy

- Choose a business expense tracker with strong data encryption

- Implement role-based access controls for sensitive financial data and bank accounts

Handling Exceptions

- Create custom rules in your expense tracker app for unique business expenses

- Establish transparent approval workflows for exceptions within the business expense tracker

International Expenses

- Select expense tracker apps supporting multiple currencies

- Implement features for VAT reclaim and compliance when you track expenses abroad

Future Trends in Expense Tracking Technology

- AI and machine learning for predictive analytics and fraud detection in expense tracking

- Blockchain technology for enhanced security when you track expenses across multiple systems

- Deeper integration with travel booking systems and bank accounts for comprehensive expense management

- Sustainability features for monitoring and reporting on eco-friendly business expenses