There have been a lot of changes in 2020 in regards to the US overtime policy salary history bans in Ohio, New York, and New Jersey, and the federal mileage rate. In addition to that, the IRS recently changed Form W-4 for employees and employers starting in 2020. This change leaves employees and employers wondering what they need to do moving forward. Luckily, most people don’t have to worry about changes; however, if you’re thinking about getting a new job or hiring new employees in 2020, you’ll want to acquaint yourself with the new Form W-4.

What is Form W-4?

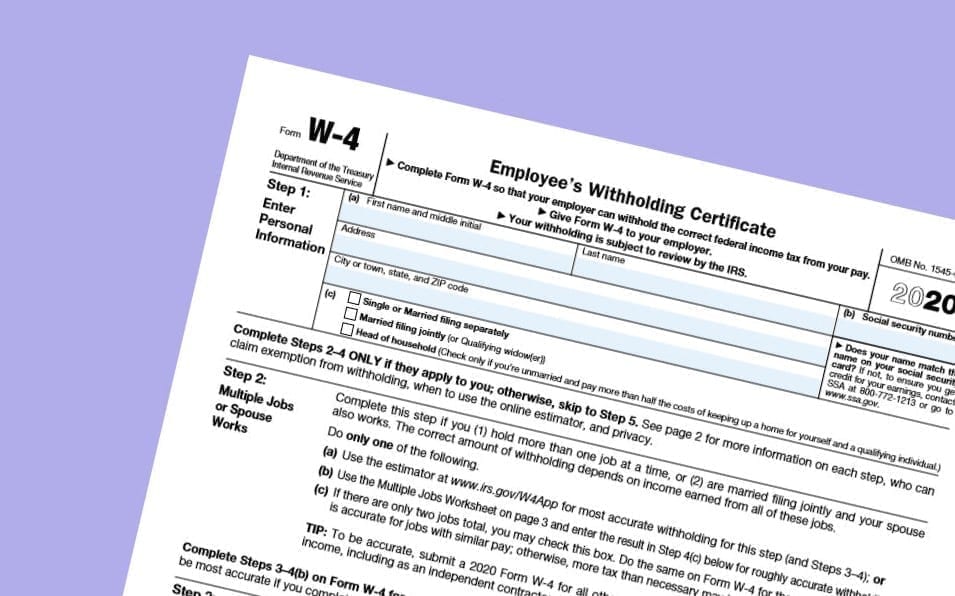

Form W-4 is a tax form that employees complete. This form lets employers know how much money to withhold from employee paychecks for federal taxes. If employees complete the form and choose to withhold, they usually see a big financial return during tax time. However, if employees claim exemption or withhold too little, the IRS warns employees that “You will generally owe tax when you file your tax return and may owe a penalty.” In order to get the best outcome, the IRS has a guide that explains how one should fill out the form.

Why the IRS Updated Form W-4

The previous form calculated a taxpayer’s income tax using the employee’s personal exemption amount. In 2017, the Tax Cuts and Jobs Act changed deductions, tax credits, and other items. Since the old Form W-4 included personal exemptions, it caused taxpayers inaccuracies in their taxes. As a result, the IRS updated Form W-4 and took away any questions correlated with personal exemption. This new form will increase transparency, simplicity, and accuracy, which will hopefully make this form a lot easier to complete.

Who has to fill out the new Form W-4?

Any employee hired and paid after 2019 must fill out the updated form. Employees do not have to fill out the new form if they completed Form W-4 before 2020. Also, if any employee wants to adjust their withholding information, they must fill out the new form.

Employer Action

An employer must give Form W-4 to all employees upon hiring. All new employees paid after 2019 are required to use the new redesigned form. If Form W-4 isn’t complete, the IRS will treat them as a single filer without any other adjustments. According to the IRS, “This [single filer] means that a single filer’s standard deduction with no other entries will be taken into account in determining withholding.” This same rule applies to any employee that’s re-hired in 2020.

Employees hired and paid before 2020 are not required to fill out the new form. Employers can ask them to fill out the new Form W-4; however, it’s not necessary because their previous furnishings are still valid.

Employee and Employer Takeaway

Overall, if you’re an employee who filled out Form W-4 and were paid before the start of 2020, you do not have to re-file. However, if you plan on changing your withholding information, you are required to use the new form.

If you are an employer, you must only make sure that you give your new employees the updated Form W-4. Once you file this, your employee will be compliant.