Can You Deduct Car Expenses and Mileage on Your Taxes?

Employees are no strangers when it comes to using their personal vehicles for work purposes. Some employees travel to and from multiple job sites, some use their car to complete work tasks, …

Home > tax return

Employees are no strangers when it comes to using their personal vehicles for work purposes. Some employees travel to and from multiple job sites, some use their car to complete work tasks, …

Didn’t do your taxes yet? You may have some more time, according to the IRS.

If you’re a procrastinator, much like the 50-million people who didn’t file their taxes in 2019 until April 15th, I have good news for you! The U.S. Department of Treasury and Internal …

If you’ve ever been involved with any business travel, you may have heard of the term “per diem”. It’s a type of reimbursement that employers give employees when they’re traveling for work …

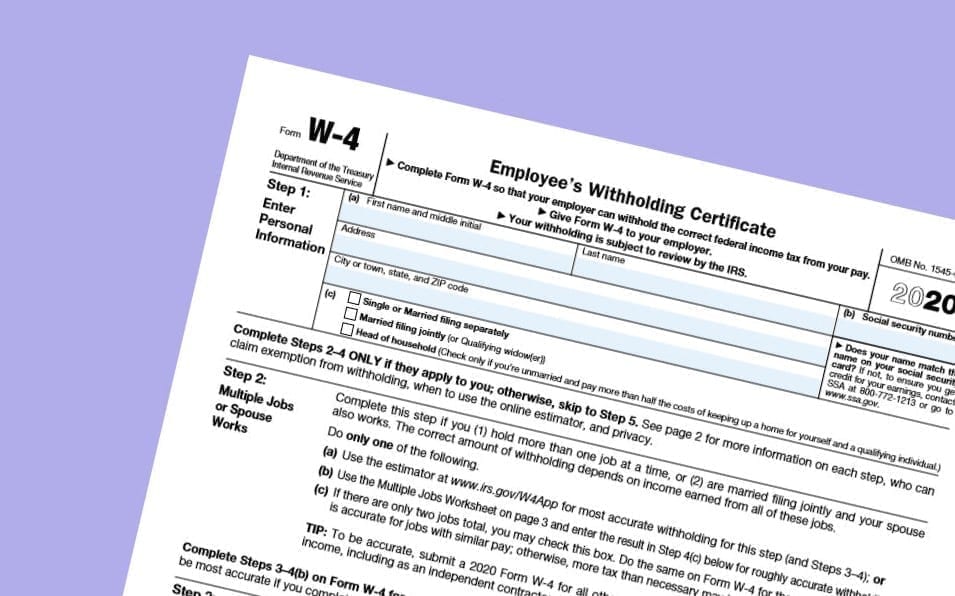

There have been a lot of changes in 2020 in regards to the US overtime policy salary history bans in Ohio, New York, and New Jersey, and the federal mileage rate. In …

* As of March 21st, 2020, The Treasury Department and Internal Revenue Service extended the federal income tax filing due date from April 15, 2020, to July, 15, 2020. Taxes are difficult …

We Help Thousands of Employers Manage Time, Time Off, and Expenses