Understanding fixed and marginal cost is a must for small businesses. Knowing how much it will cost to produce one more item or provide one more service helps a business form a competitive and profitable pricing structure, create coupons, and give discounts.

This is marginal cost and it is the key element to understand in order to stay afloat in a competitive market.

Fixed Cost Versus Marginal Cost

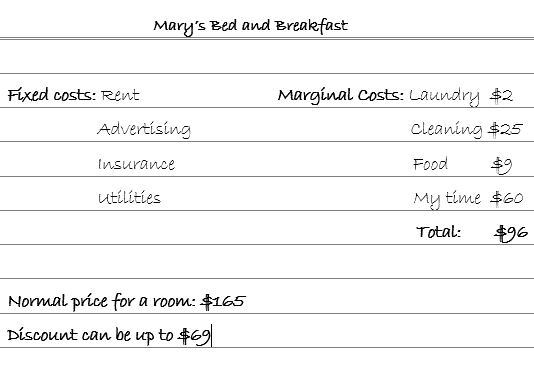

- Fixed costs are those that the company has regardless of sales, like employee training, rent, equipment costs, insurance, advertising, utilities, and other industry-specific costs. In order for a company to be in business, all of these fixed costs must be taken care of, whether the business sells a lot, a little, or nothing at all.

- Marginal cost can help a small business owner determine pricing, sales, and discounts. A business owner needs to start thinking about margin when considering whether to produce more product. The amount of this expenditure is known as marginal cost. This concept is important for all stages of business from those just getting started (where ‘more product’ is simply greater than zero), to well established companies looking to expand, and businesses who experience seasonal lulls.

How to Calculate Marginal Cost

To find your marginal cost, determine how much you will have to pay right now to produce the item or provide the service – so, anything on top of what you would pay anyway if the customer was not knocking at your door.

For example, for a sprinkler installation company the marginal cost might include the cost of gas and materials. The employee would be sitting around in the office regardless of whether the company had a lot of work or a little, so you can’t include his wage. On the contrary, a cleaning service schedules employees based on actual work so this employee’s wage is part of the marginal cost. In addition to the wage, you would include gas and the cost of cleaning products.

Notice that our sums do not include the cost of the website or workman’s comp insurance, etc.. It just includes any extra costs that you would have to incur right now to get the job done. In many cases, like the distribution of digital media, for example, the marginal cost is zero. This is true of many internet-based businesses. That isn’t to say that the cost of doing business is zero but just that their marginal cost is zero.

Basing Pricing Discounts on Marginal Cost

Understanding your own marginal cost as a small business owner is very important so that you don’t go broke providing your products and services too cheaply and so that you don’t price yourself out of the water – losing business to competition that had the sense to offer lower, yet reasonable prices. You need to know how much it costs you take on more client or make one more item so that you can set competitive and profitable pricing, know your cap for discounts and coupons, and whether you should accept or decline a bargain hunter’s offer.