Many business owners like to convert overtime to comp time both to save money and to give employees an optional benefit, but beware; this practice might get you into trouble.

Converting overtime to comp time is fine if you are a government employer but most private sector companies cannot legally do this. (Take a look at the Department of Labor website for detailed information on this.)

For non-exempt employees, employed by a private company, employees must be paid overtime at 1.5 times the rate of pay. This cannot be transferred as credit for days off. It must be paid through payroll.

However, government employees and salaried employees may use overtime in exchange for time-off.

- Government employees – Government employers are granted an alternative way to compensate employees by exchanging overtime hours for comp time. This exchange is not a requirement and it does have to be agreed upon by the employee.

- Salaried employees – Salaried employees are not owed any overtime but some business owners like to offer comp time for the hours employees work over 40 as a benefit. For employers that offer this benefit, our system allows you to easily keep track of it.

How the Feature Works: Overtime to Comp Time

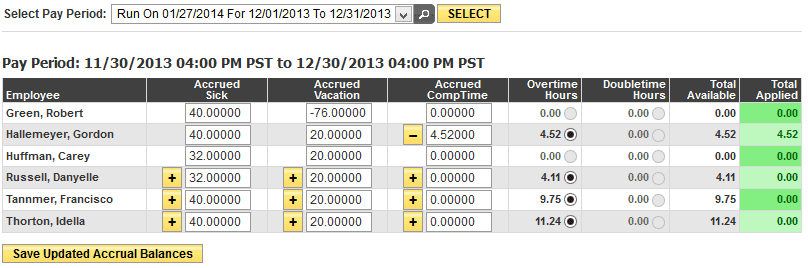

In our accruals tracking system you can easily transfer all or part of an employee’s overtime hours to comp time (or some other time off category). We have provided a table which allows administrators to add overtime and double time hours to one of three time-off categories.

The entire workforce can be issued comp time at once from one pay period.

One Response