Editor’s Note: To view the mileage rate information for 2021, please go here.

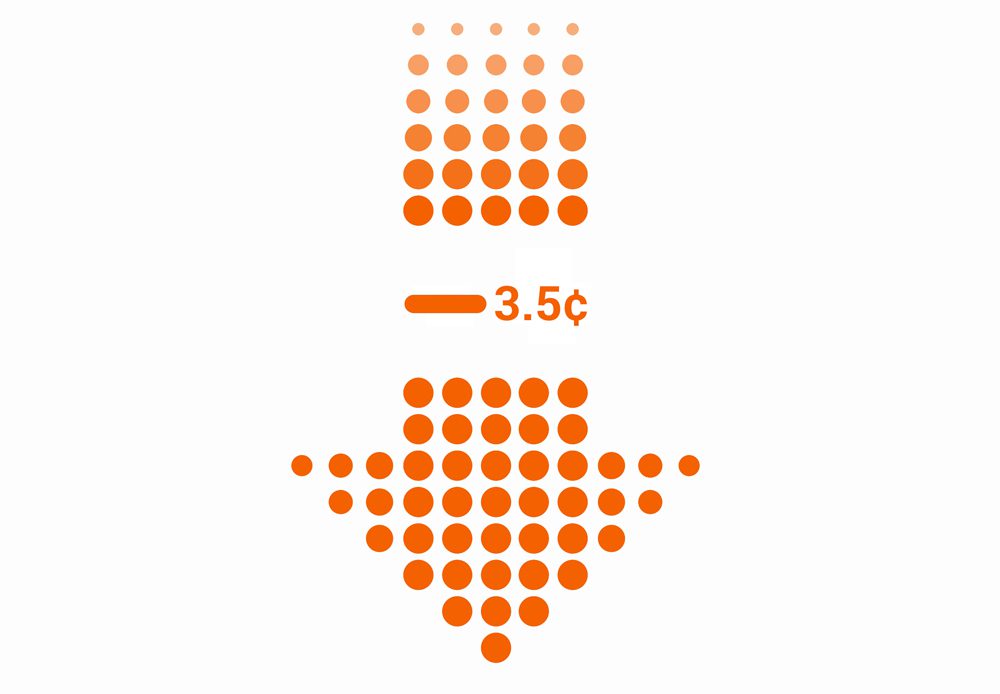

The IRS Standard Mileage rate changes each year based on gas prices and other factors. This year, the reimbursement rate has lowered. The rate for business miles driven – i.e. employees driving their own vehicles for work purposes – has dropped 3 and a half cents. For someone who drives 100 miles in a week for work, this is a difference of three and a half dollars.

The New IRS Mileage Rates Are:

- 54 cents per mile for business miles driven, down from 57.5 cents

- 19 cents per mile driven for medical or moving purposes, down from 23 cents

- 14 cents per mile driven in service of charitable organizations

What Is the Rate For?

Most employers don’t have to reimburse employees for mileage (unless reimbursement is a state law), although it’s generally good practice. The IRS rate serves three purposes:

- As a guide for employers to offer a fair reimbursement rate

- The rate that employees can use to claim mileage deductions on their taxes.

- The rate that helps employees know whether they need to claim any excess reimbursement as wages.

How to Track the Mileage

Timesheets.com makes it easy to reimburse mileage. Employers can set the mileage rate and then employees can enter their mileage as an expense. In the notes section of the entry, employees should include the odometer readings.

One Response