Many employers must use the by hours worked accrual rate to satisfy state and local sick time requirements. The laws that require employers to offer sick time also mandate the way in which that time accrues.

But that’s not its sole purpose. It is also a useful accrual rate for part time or temporary hourly employees because it helps keep employees from earning too much time off at times when they may not be working a regular schedule.

For example, an hourly employee might earn two weeks of vacation each year. For a regular full time employee, that would mean 80 hours off each year. A regular part time employee, working 20 hours per week would get 40 hours off each year (two part time weeks). But what do you give an employee that works a variable schedule? This is where the by hours worked accrual rate comes in handy.

Why It’s Useful

Employees working a variable schedule:

Employees with a schedule that varies from week to week or month to month can earn time off based on the actual number of hours they work.

The only tricky thing about this accrual rate for most online time clock systems is that when employees with variable schedules work more than full time, employees could end up earning more time off than is reasonable.

Obviously, this is a rare case. Employees who work full time aren’t usually tracking with this method, and usually when employees work more than full time but still use the by hours worked accrual rate, their employer actually wants to compensate them with extra time off based on the extra hours they put in.

But if you’re one of the employers that uses the rate and wants to ensure employees never earn above a specified amount, setting a cap on this accrual will be important to you.

Employers with sick time requirements:

Employers with mandated sick time that must accrue based on hours worked definitely fall into this category. It is often the case that these employees work enough hours to earn more than the amount required by law. At this point, employers need a system that shuts off the accrual.

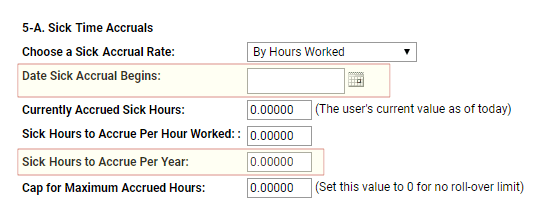

Our system includes a setting which caps the amount of time off that can be accrued in a given year based on a selected date.

An Accrual Rate on the Rise

The need for the rate is growing as more localities implement sick time requirements. More and more states and cities each year require employer paid sick time.

2 Responses

Hello,

Thank you for all your useful pages! I run a childcare inside a church. We have the same EIN and currently no distinction in company ID’s.

One of our roles is a driver during the school year and only on days scheduled by the county.The driver role does not come with PTO by itself. The person filling the role is also an employee of the church. The childcare is responsible for paying the church back for all payroll associated with the center.

Is PTO determined by the total number of hours worked by an employee despite the roles being filled? Or since the driver role would not accrue any time, should the PTO be restricted to the hours worked for the church?

Would applying for two different company ID’s be beneficial? Help!

Hi,

If I understand you correctly, I would say the employee should get PTO based on the number of hours worked total, for you and the church. If you applied for two different company IDs, then this driver would now work for two different companies and get two separate paychecks. PTO benefits would be offered separately. The employee might not care for that scenario. However, if your business is truly separate from the church, separating the business entities might be a good idea.