Recently, the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) put out a guide to help small businesses understand and follow the new rules for reporting who owns and controls their company.

This guide, named the Small Entity Compliance Guide, provides information about the reporting rules and addresses common questions. It also equips businesses with helpful tools such as checklists and visuals to facilitate their understanding of the rules set to become effective on January 1, 2024.

Purpose of BIO Reporting

So, what’s the point of the BIO reporting? This new reporting requirement is part of an effort to tackle illegal activities like money laundering, terrorism financing, and tax fraud. The Corporate Transparency Act, which passed in 2021, makes this rule mandatory and applicable to most companies.

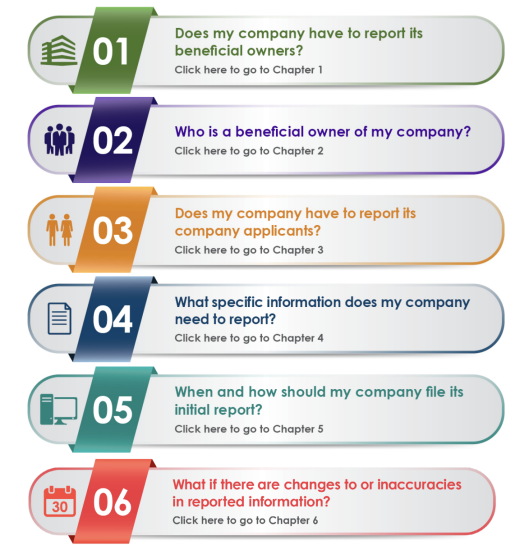

The guide answers six key questions about the reporting rules:

Beneficial owners, in simple terms, are the people who own or control a company. Reporting this information can help law enforcement agencies prevent illegal activities and protect national security.

BIO Compliance Dates and More

Starting on January 1, 2024, companies will be able to report this information to FinCEN. Companies created or registered before this date will have until January 1, 2025 to make their first reports. For companies created or registered on or after January 1, 2024, reporting will be required within 30 days.

It’s important to note that some organizations, like the American Institute of CPAs (AICPA), have raised concerns about the complexity and lack of awareness surrounding the BIO reporting rules. They’ve even supported a proposal to delay the start of reporting. So, if you’re a small business owner, make sure to stay informed about these requirements and seek guidance as needed to ensure compliance.