How You Get Overtime On a Week With Under 40 Hours

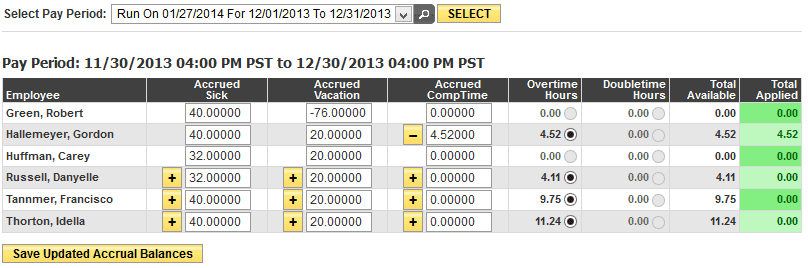

Occasionally, we hear from customers who want to know why an employee has overtime on the payroll report but does not appear to have overtime on the timecard. Under normal circumstances, the …

Occasionally, we hear from customers who want to know why an employee has overtime on the payroll report but does not appear to have overtime on the timecard. Under normal circumstances, the …

Overtime violations fit into a category called wage theft. And the thieves are, in this case, not the poor or needy, but the more fortunate business owners. While they would hardly call …

Many business owners like to convert overtime to comp time both to save money and to give employees an optional benefit, but beware; this practice might get you into trouble.

Mileage reimbursement is not mandatory in the US (in most cases), however, the IRS issues a yearly Standard Mileage Rate for use by employees and employers in the following ways: The rate …

Timesheets.com integrates with Quickbooks for Desktop and Quickbooks Online. If you want to use QuickBooks with your Timesheets.com account, you can learn how to set it up here.

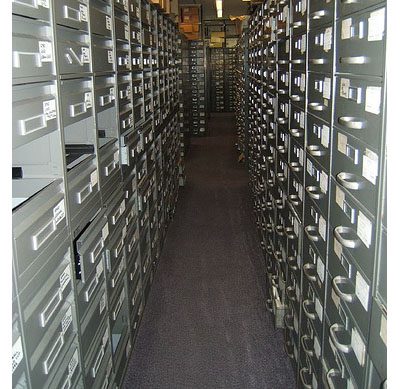

Did you know that you are required to retain your employee’s time records for at least 3 years? After terminating an employee, the temptation might be to dispose of the records but, …

Employers who operate multiple companies don’t always realize that their employees who work for both must have their hours at each company combined for overtime calculations. When employees work for two different …

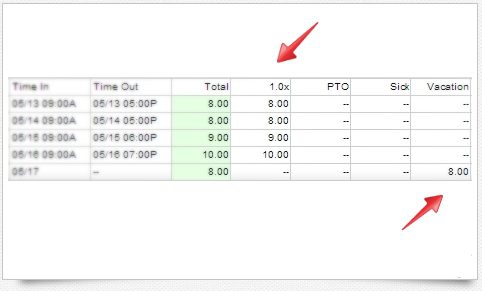

Do vacation hours count as overtime? This is a common question among employers and employees alike. If an employee takes 8 hours of vacation or PTO on a week where he works …

I have heard this question asked countless times over the years: “Why does your time tracking system only calculate overtime after 40 hours and not after 80 hours?” The answer is, because …

Every company needs to keep track of employee time – whether that’s accomplished with antiquated paper timesheets or sophisticated web-based applications, it is needed in order to know how many hours to …

We Help Thousands of Employers Manage Time, Time Off, and Expenses