Many companies put a limit on accumulated vacation hours, and for good reason. A few years back there was an interesting case that highlights the trouble a company could get into without it.

A Nebraska County employee, Dick Kincaid, had accumulated 688 vacation hours over 30 years. That would amount to a huge payout upon termination of employment or over 17 weeks of vacation if he had decided to take the time off. He didn’t, however, and he was eventually fired for it.

If an accruals cap had been set from the beginning, Kincaid would have never accumulated so many hours and would have never lost his job over it.

Automated Accruals Tracking

Automating accruals can significantly improve the business process of paid time-off. The human resources department (or payroll manager) no longer has to manually deduct PTO hours and employees no longer have to remember what they’ve taken and what remains.

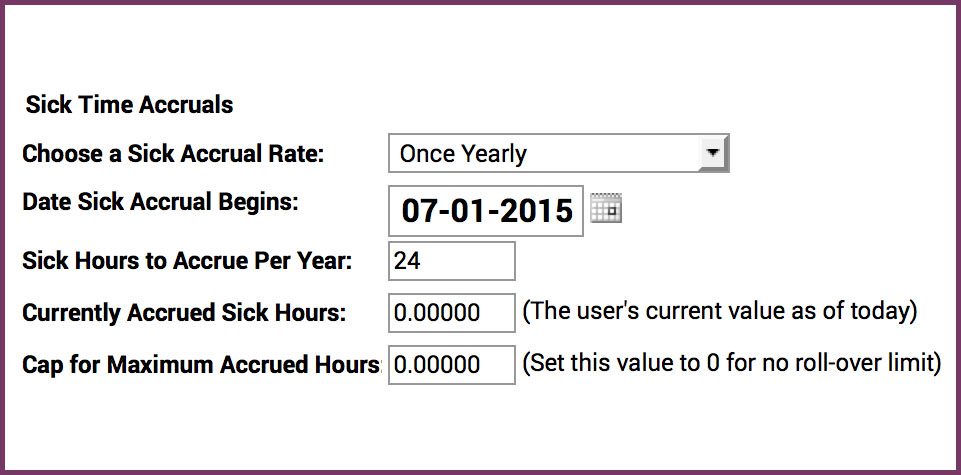

With our time tracking system accruals tracking is easy and automated. For each employee, employers simply enter the accrual rate, the hours to accrue per year, and the current remaining hours. From there the system does all the work – it deducts and adds news hours so you don’t ever have to think about it again. You don’t even have to worry about hours rolling over into the next year.

We account for that too. Here’s how:

The Cap

The Cap is a special feature which allows you some additional flexibility with accruals tracking.

Capping an employee’s accruals prohibits them from accruing any more time than that which has been allowed to them each year. By adding a cap to the time off policy, employees can only accrue a certain amount of time-off and no more. This means that if, after a year, they have not taken their time-off, the system stops accruing.

For an employee that is allowed 40 hours per year, setting the cap at 40 ensures that the employee never goes above 40 hours, even into the next year. Once the employee uses some of his or her time-off, the system will start accruing it again.

The feature is flexible, however, and does allow an employer to set a customized limit on the allowable roll-over. For example, if the employee never took the 40 hours but you want your employee to keep half of what she earned but never used, then you can set the cap at 60. This way, after the year has gone by and the employee still has 40 hours, the system will continue to accrue time until she gets to 60. At that point it will stop until she uses her time-off.

Use-It-Or-Lose-It

There is another type of “cap” that our customers frequently ask about which clears out the employee’s time-off. With Use-it-or-lose-it policies, rather than just setting a limit for accruals, employers want to clear out the time so that nothing rolls into the next year. Employees then start accumulating again after their anniversary date.

We don’t offer a no roll-over type of cap. Here’s why:

If employees lose all their time-off in one fell swoop at the end of each year (or yearly cycle), they will be scrambling to take their time-off at the end of the year. If all employees renew on the first of the year (which is common), then the entire workforce will be scrambling to use their time-off at the end of the year. This will either make for a very understaffed office or very unhappy employees that didn’t get to go on vacation. Additionally, no employee will ever be able to take time-off in January because their time-off will have been cleared at the end of the year.

Neither of these eventualities are very practical. This is why we set an accrual limit instead. Additionally, some states do not allow this type of time off policy, including California, Nebraska, and Montana.

10 Responses

I work with people who say they have to take time off because they stopped accruing PTO, since they have maxed out. I try to tell them that they are not losing anything because they are not entitled to anything, since they have hit their max. I could understand that, if we lost all of our accrued PTO at the end of the year or on our anniversary date. But we don’t, our PTO rolls over. You just can’t accrue over what you’ re allowed based on years of service.

Am I missing something ? Could I have it wrong ?

Hi Ken,

I think what your coworkers/employees are feeling is that they won’t get to take the full time off benefit if they don’t take it before they max out. The policy is fine but employees just want to make sure they get the most out of the benefit.

They are losing something. They are losing paid hours by not accruing anything further – hours they would be getting if they were not at the max.

I do not understand why the guy lost his job over it or why companies feel the need to have a cap. Is money not set aside for PTO when it is accrued? That seems to me a good accounting practice.

Rick, You need to study HR and Good accounting practices for companies before you make such mindless remarks. Have you ever owned a company? Most likely not, if you are commenting as you are.

PTO is totally an accrued expense and a liability on the books. I know a lot of small businesses, that the revenues are so small that standard accounting practices can be throw out because it’s insignificant to their small operations. Owning a small business does not make you a business master.

I have a question about cap accrued PTO. Am I losing PTO hours by not accruing further more hours once my PTO reached the max? Is that legal in Colorado?

Hi Vickie. Colorado law does not require employers to give employees vacation time, and time off policies are set and implemented by employers. This means that time off policies are based on an agreement between employers and employees. A PTO cap is most likely legal in your case. I’m not sure what you mean by “losing hours” and I’m not familiar with your PTO policy, but typically a cap is placed after you’ve reached a certain amount of time off hours. It doesn’t mean that you’ll lose the hours you’ve already accrued, it just means that you’ll stop earning more PTO hours. I suggest that you speak with your supervisor so they can clarify your policy for you.