Convert Overtime to Comp Time

Many business owners like to convert overtime to comp time both to save money and to give employees an optional benefit, but beware; this practice might get you into trouble.

Many business owners like to convert overtime to comp time both to save money and to give employees an optional benefit, but beware; this practice might get you into trouble.

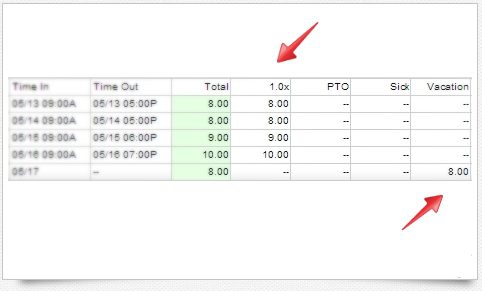

Do vacation hours count as overtime? This is a common question among employers and employees alike. If an employee takes 8 hours of vacation or PTO on a week where he works …

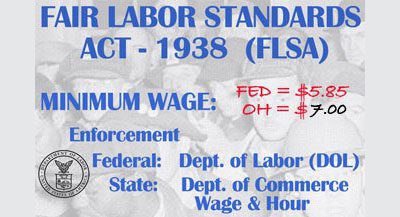

I have heard this question asked countless times over the years: “Why does your time tracking system only calculate overtime after 40 hours and not after 80 hours?” The answer is, because …

The FLSA can be a tough read. Here are some common questions to help businesses avoid overtime violations.

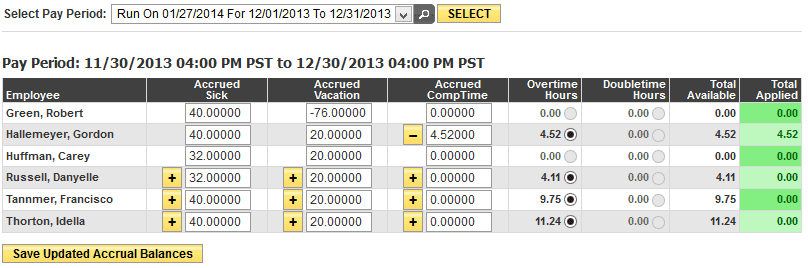

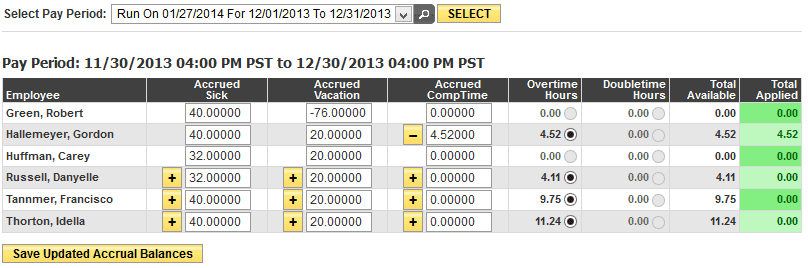

At Timesheets.com, we often get calls from customers who want help setting up “custom” overtime rules. We’ve heard the gamut of creative “overtime policies”. While having multiple pay rates is fine for …

Federal law has no provision for double time pay (see statement), but California law does. State labor laws add to Federal labor laws so that they can provide additional protections for workers. …

We Help Thousands of Employers Manage Time, Time Off, and Expenses